On Procter & Gamble and why they should further invest in physical retail. If 2019’s Las Vegas’ Shoptalk convention is any indication, the brand representation may mark a shift away from self-sustaining, direct-to-consumer (DTC) brands. Legacy competition for consumer packaged goods (CPG) looks to regain the momentum that the DTC era has hindered. Prominent DTC brands are fewer and far between, this year. At Shoptalk, Bonobos is traditionally present but the brand is now owned by Walmart. Dollar Shave Club, another mainstay, is now owned by Unilever. And Trunk Club is now owned by Nordstrom. This is symbolic, in and of itself. Like many brands in the DTC space, they are increasingly dependent on traditional retail channels to achieve critical mass.

Of this year’s Shoptalk attendees, fewer are there to represent top 100 or so DTC brands. Here is a short list of the digitally vertical brands in attendance: Allbirds, Brandless, Boxed, Dirty Lemon, Everlane, Frank + Oak, Glossier, Harry’s, Mack Weldon, Mizzen + Main, Native Deodorant (Procter & Gamble), and Tuft & Needle. Of these, few have shunned wholesale retail and even fewer have shied away from physical retail development. While these companies have moved upon the traditional landscape with major retail partnerships, acquisitions, or physical retail growth, traditional powers have been slow to account for the resulting changes.

In the most recent Member Brief, we published The Target Report:

Target, Walmart, and Amazon (TWA) are each facing the commoditization of online grocery sales as new challengers continue to hinder TWA’s market cap growth. To address these challenges, each retailer is adopting product marketers and DTC brands are sources of new business and loyal customers. In each case, TWA are positioning themselves as practical homes to fashion, beauty, electronics, and lifestyle brands. Amazon is aggregating. Target is curating. And Walmart is acquiring.

While the grandeur of DTC brands may be dwindling, legacy brands like Unilever and Procter & Gamble (P&G) are reinvesting into DTC era solutions. Between 2010 and 2019, CPG challenger brands established a momentum that traditional companies have had to counter. As of yet, traditional companies have yet to mount a true offensive against challengers and the retailers that have courted them. According to Happi Magazine, P&G is responsible for 18% of Walmart’s in-store sales. This number is up from 15% in 2016. This number has grown, thus far, despite Walmart’s heavy investment into DTC operations, exclusive CPG partnerships, and private label development.

2PM Data: P&G CoNTEXT

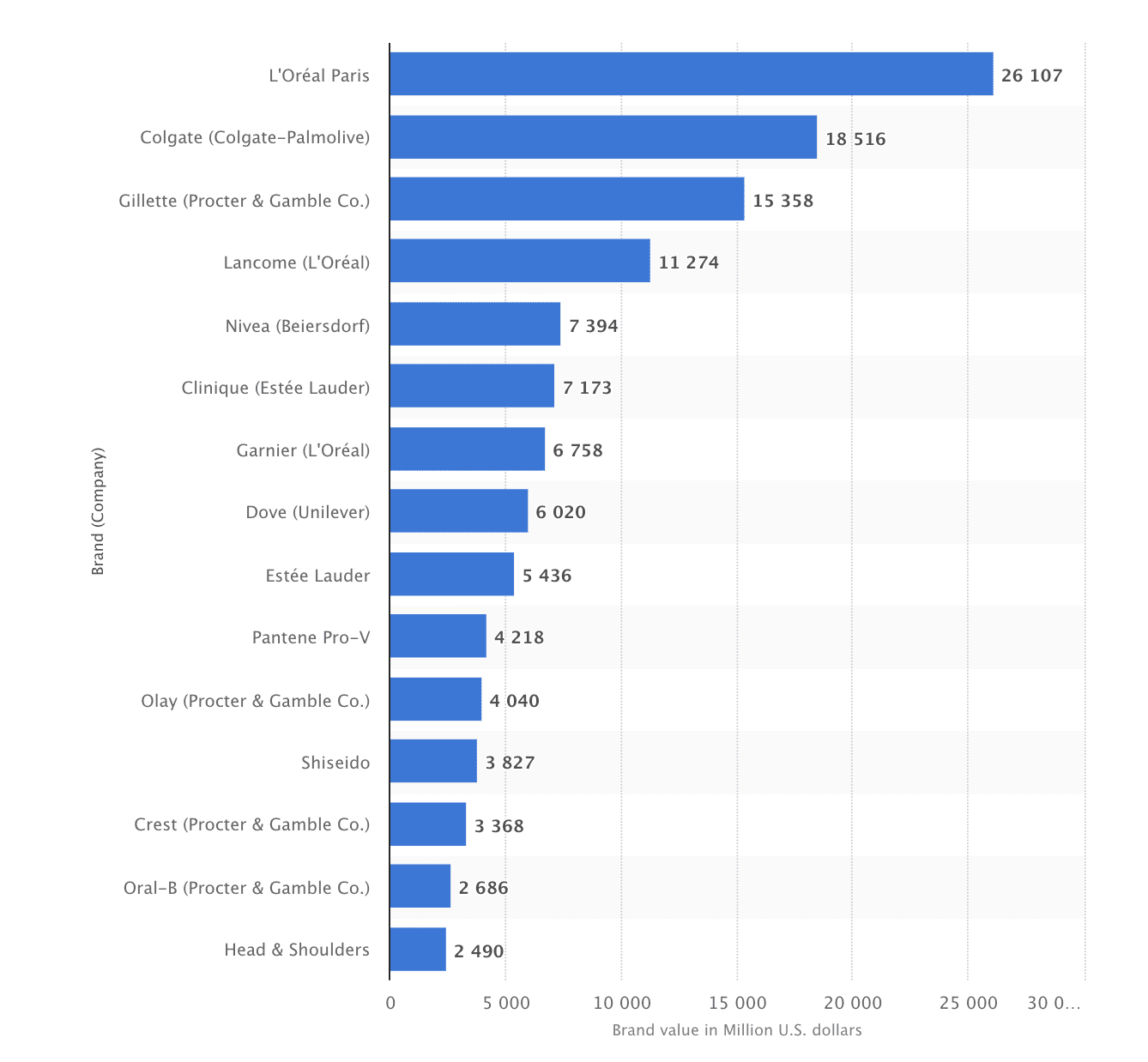

P&G is at a crossroads. The 182 year old consumer brand earned its highest revenue figure in 2012 and has yet to reach those heights since, though they have successfully cut expenses and bolstered profits. Even so, P&G’s 2018 net income figure was the second lowest in their last 13 years. This diminished position corresponds with the growth in DTC retail sector. This growth along with the continued development of well-marketed private label CPG brands at big box retailers has resulted in increased substitution for traditional products from marketers like P&G and Unilever.

Redefining Direct to Consumer

There is a remarkable opportunity for P&G to leverage their products in inventive, new ways. The Cincinnati-based company recently launched Tide Cleaners, a franchise retail experience and service center for dry cleaning. Franchisees gain access to the most recognizable brand in home goods and Tide gets a new retail channel to sell products, build affinity, grow top funnel advertising, and realize service-driven revenue streams.

Tide, one of P&G’s most recognizable brands, has been repurposed to present an on-demand laundry service. Tide Dry Cleaners allows customers to select their desired service in-app, pay, and then drop off their clothing at the storefronts to be picked up when push notified. Customers will return to find their clothes washed, dried, and folded. These dry cleaning storefronts now run in Cincinnati, Boston, Chicago, DC, Philadelphia, Denver, and Dallas. This new retail experience begs the question: why not expand into vertical retail with physical “Everyday” storefronts?

On “P&G Everyday” and defensibility. As of 2018, Harry’s and Dollar Shave Club (Unilever) won over 12% of Gillette’s market share thanks to their direct model and partnerships with retailers. Procter and Gamble would further benefit from the development of a DTC physical retail model. By owning their in-store “Everyday” experiences, P&G would be able to meet a few objectives that would be useful as Amazon, Walmart, and Target continue to develop competing home goods brands to address their own profitability concerns.

- Physical stores could reduce dependency on Walmart and Target as primary sales channels while giving P&G more leverage to negotiate better terms and in-store marketing collateral at Target and Walmart or on Amazon (currently an advertising partner).

- By going direct to consumer, these owned storefronts would cut P&G’s dependency on wholesale relationships, promoting higher margins per sale.

- With owned storefronts, P&G would be capable of launching their own delivery services and last mile operation.

While “direct to consumer” is the buzz phrase of this era in retail, physical storefronts are once again becoming critical components in a healthy customer acquisition ecosystem. But brand manufacturers can no longer rely upon big box retailers to run the way that they did prior to this era. Digitally native brands are prioritizing physical retail to reduce customer acquisition costs and build long-term loyalty. As a result of this shift by internet-first retailers, big box retailers like Walmart and Target have prioritized partnerships and acquisitions with these brands to drive their customers to their stores.

Walmart Inc. hopes to boost profits by charging for in-store and online advertising by some of the retailer’s biggest suppliers, including Procter & Gamble Co.

The DTC era of retail has begun to place marketers like Unilever and P&G at a disadvantage. Just ten years ago, P&G owned the grooming and beauty aisles at stores like Target. In some stores, Harry’s and Flamingo installations are the most visible. In others, its Native’s deodorant or Casper’s pillows. As third-party retailers like Walmart reevaluated shelf space and in-store marketing, P&G began to lose control of their product presentation. But their commitment to direct-to-consumer business models is a sign that this disadvantage may be short lived.

In addition to the Tide Dry Cleaner franchise system, P&G is experimenting with digitally-native brands. In addition, the company continues to test new online retail formats with BigCommerce. But it’s the direct store format that could offer physical retail growth and brand defensibility amidst the continued evolution of retail. A P&G owned storefront wouldn’t just be a place to own relationships with old customers. It would serve as a space where P&G’s new digitally-native brands could test for and acquire new customers. Direct to consumer retail isn’t limited to online channels, DNVBs are innovating in this way. Marketers like Unilever and P&G can do the same.

Read the No. 308 curation here.

Report by Web Smith | About 2PM

[…] Legacy product brands are reasserting their strength with US consumers and retailers after years of market share losses to direct-to-consumer startups. The retail conference Shoptalk in Las Vegas this week is a microcosm of that trend. There are fewer independent DTC brands leading the show, with mainstays like Bonobos, Dollar Shave Club and Trunk Club acquired by incumbents (Walmart, Unilever and Nordstrom, respectively), reports 2PM, a commerce news company. And DTC startups that have grown into meaningful businesses mostly embrace TV and brick-and-mortar retail. After weathering a tough few years, large brands can strike back. P&G accounts for 18% of Walmart’s in-store sales, up from 15% in 2016. That’s a lot of leverage to potentially box DTC rivals out of the largest US grocery chain. If established CPGs can contain DTC growth to ecommerce and Facebookagram performance marketing, they can wait out the VC money while developing their own consumer-direct product lines. More. […]

[…] Legacy product brands are reasserting their strength with US consumers and retailers after years of market share losses to direct-to-consumer startups. The retail conference Shoptalk in Las Vegas this week is a microcosm of that trend. There are fewer independent DTC brands leading the show, with mainstays like Bonobos, Dollar Shave Club and Trunk Club acquired by incumbents (Walmart, Unilever and Nordstrom, respectively), reports 2PM, a commerce news company. And DTC startups that have grown into meaningful businesses mostly embrace TV and brick-and-mortar retail. After weathering a tough few years, large brands can strike back. P&G accounts for 18% of Walmart’s in-store sales, up from 15% in 2016. That’s a lot of leverage to potentially box DTC rivals out of the largest US grocery chain. If established CPGs can contain DTC growth to ecommerce and Facebookagram performance marketing, they can wait out the VC money while developing their own consumer-direct product lines. More. […]

[…] product marketers, like P&G, have equipped their brand management teams to infuse their operations with many of the same tools […]