With skyrocketing costs of doing business, mounting debt, and impending layoffs – Wayfair is at an impasse. The industry leader’s strategy pioneered dropshipping arbitrage with superior SEO, razor thin margins, and an direct-marketing attack that worked until volume grew and algorithms evolved with the times. Analysts have begun to question Wayfair’s long-term viability. This, as other sectors of online retail have also evolved with the times: fine-tuned checkout, brand-focused marketing, customer experience, and the logistical mastery of hard-to-deliver products.

Over a span of six months, we accepted shipments on three separate products to our home. In each case, the anticipation was high and for the most part, expectations were met. Though, our expectation of Wayfair was low. Each time, the freight truck pulled to the front and honked awaiting evidence that we were home to accept. The delivery men stepped out to hastily deliver their freight. In each case, efficiency was the name of the game. Those three orders were as follows:

Rogue (roguefitness.com): the weight was close to 500 pounds. A modular product, the delivery arrived within five business days. It arrived in five separate boxes and placed in our garage. The assembly was my responsibility and I did so eagerly.

Peloton (onepeloton.com): the weight was close to 200 pounds. It was ordered and delivered within seven business days. The delivery men took the time to assemble the product in its rightful place.

Wayfair (wayfair.com): the combined weight was close to 300 pounds. The two pieces arrived separately and over three days. It was ordered nearly 40 days prior. There were no clear expectations around delivery windows but that seems to be commonplace for Wayfair. There was no assembly. However, the two delivery men feared liability concerns so they brought the two boxes into the home before unboxing.

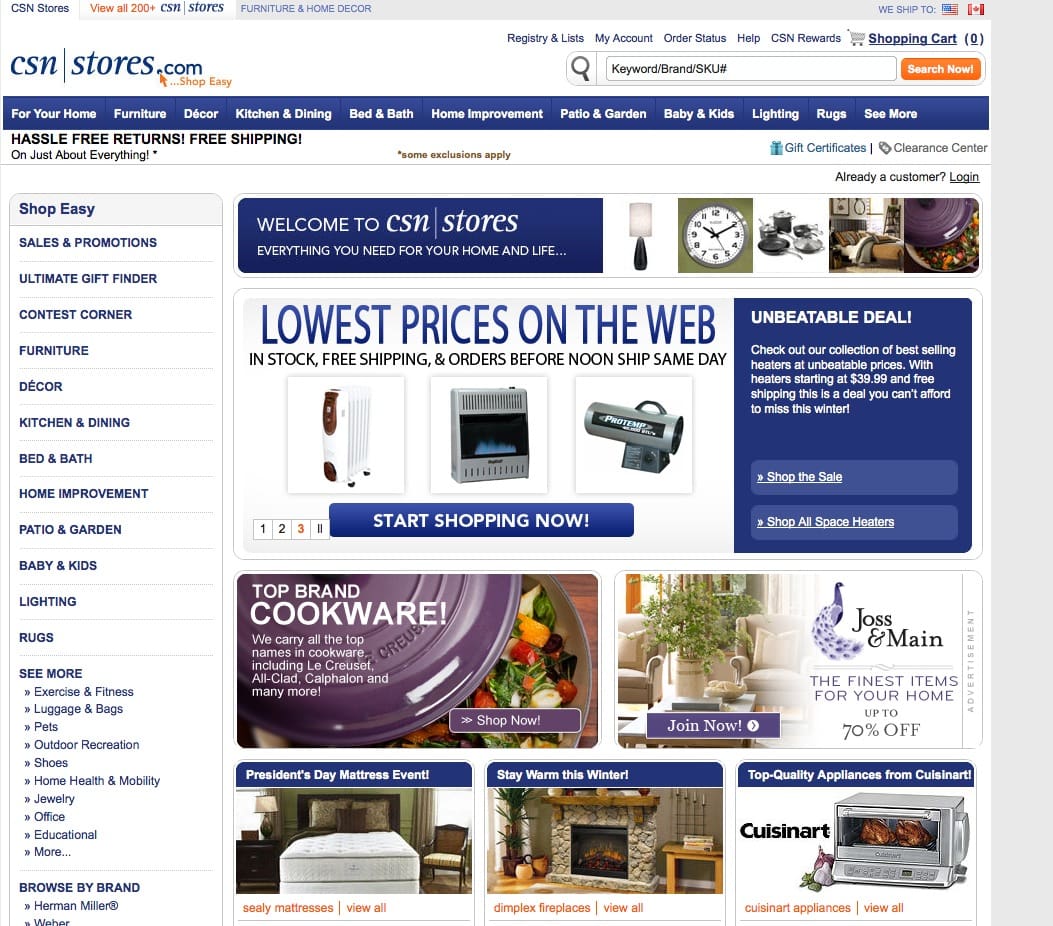

Founded in 2002, the online retailer excelled, achieving an initial public offering in 2014 and raising over $300 million. The company deserves a tremendous credit for its longevity, a rarity in the web 1.0 era of online retailers. Not only was the market in its primitive stages, investors were incredibly skeptical. In the wake of the dot-com crash, furniture makers were weary as well.

To account for this, cofounders Niraj Shah and Steve Conine launched CSN Stores, a combination of their initials that served as a masking agent for their internet-first intentions. The two founders avoid the dot com classification altogether. It worked. Perhaps, had the company launched as Wayfair.com in 2002, the early and pivotal support that Shah and Conine received could have been diminished. Shah and Conine anchored an exceptional story of a private startup gone public. To put the company’s growth into perspective, CSN Stores hit $100 million in annual revenue by 2006 and $380 million in revenue by 2011. These numbers are extraordinary compared to many of today’s eCommerce startups. Even so, CSN Stores launched before the pioneering of tools like Shopify or the emergence of third-party logistics platforms like Rakuten or Shipbob. With eCommerce democratization came more companies competing over the marketing advantages, ones that would prove to be more finite than any in the industry would believe at the time. Wayfair’s ascension was a reflection of a few technical marketing advantages that worked until they did not.

Wayfair and its diminishing advantages

The majority of Wayfair’s goods are acquired from a foreign factory or importer warehouse. Once the marketplace acquires it from an intermediary, it ships to the home of the buyer. The core of Wayfair’s business is to avoid holding merchandise, a method that lowers front-send costs but limits upside growth. To improve delivery: Wayfair launched CastleGate, a third-party logistics company of their own. The 3PLs objective was to shorten the time between imports arriving in American warehouses and products being delivered to consumers across the continental United States.

With CastleGate, we effectively act as a third-party logistics provider to our suppliers, taking no ownership of inventory and receiving fees from suppliers for inventory management and fulfillment services.

And on a recent call with analysts, co-founder Steven Conine explained the company’s investment into supply chain software to improve product and routing from importer houses to CastleGate’s 3PL warehouses. Wayfair is making an effort to verticalize their business and it remains to be seen whether or not the current restructuring could see this strategy through.

When Shah and Conine took Wayfair public in 2014, they couldn’t have anticipated the uphill battle that would lie ahead. By 2016, the marketing arbitrage that had helped them scale into a multi-billion dollar brand would begin to diminish as online retail democratized. In addition, legacy furniture retailers would begin to struggle for a number of their own reasons. In short, 2014 may have been Wayfair’s best year. Daniel McCarthy, Assistant Professor of Marketing at Emory University wrote (2017):

If Wayfair were able to reduce its CAC to Overstock’s level, we estimate that Wayfair’s expected valuation would more than double, all else being equal. Of course, all else is not equal – Overstock is pursuing a more conservative customer acquisition strategy, acquiring a smaller number of higher lifetime value customers. [1]

Instead, the opposite happened. Between 2014 and 2019, Wayfair’s marketing spend skyrocketed, coinciding with mounting losses. At IPO, Wayfair was spending $179.3 million for its $1.31b in revenue. By 2018, Wayfair was spending a much less effective $664 million for its $6.82 billion in TTM revenue.

However, as the company has grown, losses have widened. This is symptomatic of its rising marketing costs and thinning margins. Wayfair’s drop-shipping model once made it an efficient growth machine but only if marketing costs remained steady. In a recent edition of Retail Dive, Caroline Jansen reported on the recent layoffs of nearly 550 front office employees, 350 of these employees worked in the headquarters of the Boston retailer. In addition to the aforementioned negative trends, Wayfair’s current restructuring coincides with mounting debt, a figure that will exceed $1.4 billion.

However, since its public debut in 2014, the e-commerce player has failed to post a profit. In its past quarter, Wayfair’s net loss widened 80% to $272 million, while its long-term debt swelled to $1.4 billion, from $347 million the year prior. [2]

What makes these figures spectacular is Wayfair’s market position. Wayfair is the leading online retailer for furniture, a shift from 2018 when Amazon owned 31.1% of the online retail market for furniture. Today, Wayfair owns 33.4% of the market after growing sales 34.1% YoY vs. Amazon’s category growth of 8%. Only Wayfair and Macys.com grew their market share between 2018 and 2019.

In recent years, the company has hemorrhaged money into advertising and improving its inventory selection, investments that have failed to improve the company’s “already wafer-thin margins,” Neil Saunders, the managing director of GlobalData Retail, said previously. [3]

Despite its longevity, there is little that is appealing or intuitive about marketplace retailers as its industry matures. However, there are a number of brand retailers that are appealing to consumers in ways that align with the best practices of today. These include: Serena & Lily, Joybird, Article, and Burrow. The top ten vendors, however, remain more marketplace in functionality. They are are as follows: Wayfair, Macy’s, Walmart, West Elm, CostCo, Home Depot, Amazon, Pottery Barn, Target, Ikea, and Overstock. This begs the question. If Wayfair couldn’t profitably scale its DTC channels before, can it find a path to profitability today?

A logistic company should never be a brand. A brand should never be a logistics company.

Nate Poulin, DTC executive and consultant

A number of logistics companies have embraced brand management strategies and vice versa. This, in addition to the current industry standard: timely delivery, efficient sourcing, or even a digitally-native approach to sales and growth. A number of freight-reliant brands have mastered supply chain to this extent. To an earlier point, this includes brands like Peloton and Rogue. I recently posed the question: why is the furniture industry so much worse than every other product category? Here were a number of the top responses.

Josh Johnston, Senior Director of eCommerce Strategy

Josh Johnston on Twitter

@web Logistics. Pricing can be difficult if the business has a commission model at store level. Better deals in store. Lots of regional players (even as franchises for large national brands) which has delayed investments in eComm vs traditional retail.

Humayin Rashid, eCommerce Agency Founder

hum on Twitter

@web I can only speak from limited experience working with a global furniture manf trying to go DTC. 1- Last mile delivery is impossible-ish 2- Supply chain is a mess 3- C-Suite team w/ limited eComm expertise 4- Product categories w/ limited differentiation for end consumer

Steven Dennis, Retail Veteran and Strategic Advisor

Steve Dennis on Twitter

@web The driving factors are supply chain related costs, which are exacerbated by high return rates and the tendency of lower value, more commodity like, items to be the ones bought online. Of course the also have the whole CAC issue (both marketing and price promo).

Frederico Negro, Founder of a Furniture Marketplace

Federico Negro on Twitter

@web The answer to this is nuanced. For Contract furniture I would say brands have outsourced their customer relationship to dealers for decades and are now stuck. For large d2c brands like west elm or ikea it’s because it’s secondary to retail

Jesse Farmer, Teacher and Computer Programmer

Jesse Farmer on Twitter

@web Costs are all around higher, from COGs to shipping. Stakes of merchandising and purchasing ⬆️⬆️⬆️, so fewer people willing to assess “fit” w/o physical interaction. Harder to build a brand; purchases are infrequent and fewer memetic growth channels. No “cool shoes!” effect.

Saleh Tayeed, eCommerce Analyst

Saleh on Twitter

@web From carriers perspective, bigger items are difficult to process through hubs, revenue per trailer is lower, and can’t be loaded on conveyer belt, needs a lot of manpower to move items, so charged a lot to recoup costs. But it’s slowly changing as carriers build more capacity.

Cole Harmonson, DTC Founder

Cole Harmonson on Twitter

@web I’ve done interiors on two houses. I mean – spreadsheets and project management. I go deep. But I will rarely buy furniture online unless I can visit it in a store. To sit. To feel fabrics. Check quality. Quick furniture scares me.

Peter Pham, Veteran DTC Investor

Peter Pham on Twitter

@web Frequency, shipping and return cost & difficult to differentiate. Also a product people want to touch & feel although with AR a gap of how it looks & fits in a room could bypass.

Wayfair’s recent struggles are another example of the dangers of a marketplace strategy that is reliant on the pricing and availability of third-party products. Though the inconveniences of freight shipping may serve as a consumer-facing frustration, internally, Wayfair’s longevity will come down to economies of scale and margin maintenance.

What the analysis found: Wayfair’s lack of verticality will continue to widen losses, even as the company makes progress in lowering costs. Though Shah and Conine have scaled an extraordinary eCommerce business, it’s decidedly different than the thriving DTC marketplaces of today – an ecosystem that includes Amazon, Walmart, Target, Home Depot. It’s possible that Wayfair’s early-mover advantage has diminished.

The industry has grown skeptical of Wayfair’s brand agnostic, drop-shipping model – a method that once relied on marketing methods that are no longer available in excess. Today’s second-wave of eCommerce retailers are digitally-natives, ones focused on brand equity, customer experience, and availability. The furniture industry is not worse than every product category. However, Wayfair’s model is. Shah and Conine must adopt the practices of its contemporaries, modern competitors that have more in common with premium fitness brands than furniture resellers. Or, they’ll have to acquire the brands for their own sake.

Research and Report by Web Smith | About 2PM