No. 291: The Sears Bankruptcy Dossier

After many years of struggles, Sears Holding Corp followed through on their anticipated Chapter 11 bankruptcy after missing a crucial debt payment of $134 million.

2PM, Inc. on Twitter

News: @Sears to file for bankruptcy after 12 PM EST. 150 anchor stores at Tier B / C malls will be closed and nearly 19,000 jobs will be lost.

History. Sears has a story that dates back 132 years. For over a century, that history was rich and awe-inspiring. From a mail order catalogue (that sold everything) to one of the largest retailers and land holders in the world – only to be surpassed by Walmart in 1987. For a long time, Sears met consumers where they were.

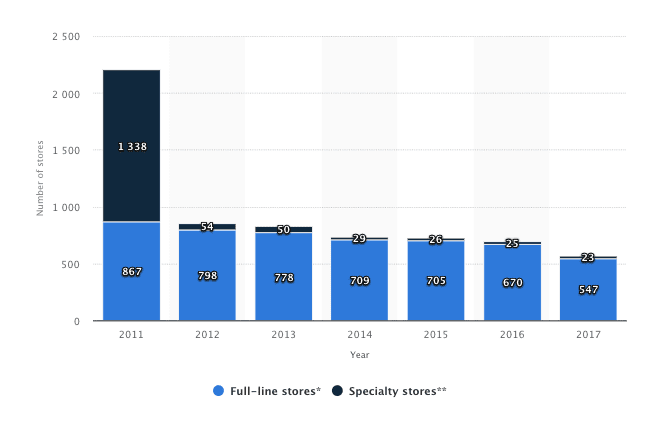

It wasn’t just that Sears failed to improve its in-store experience and merchandising strategy. Lampert also failed to see how digital could boost the overall business. According to Dennis, the e-commerce business was positioned as a separate play, distinctly different from physical stores. Using stores as digital assets with technology like buy online, pick up in store is a common shield retailers like Nordstrom and Kohl’s use to protect themselves from Amazon.

How Sears’ cost-cutting strategy sealed its fate

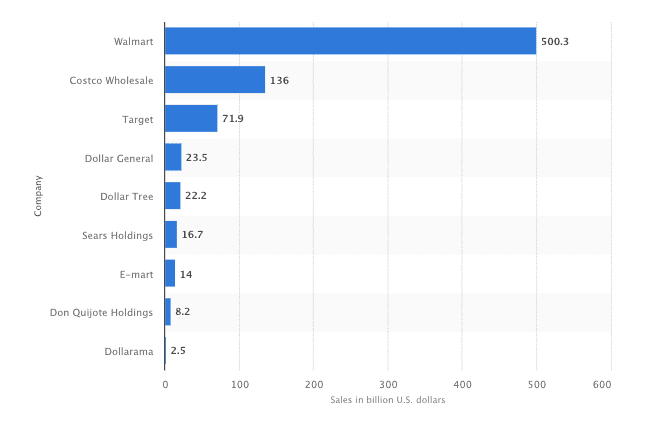

While Walmart has evolved to compete in the online-first economy, Sears has not. Of two of the top reasons that Sears’ century of good fortune began to crumble: they incurred massive debts and suffered from severe corporate mismanagement issues.

Web Smith on Twitter

TIL: @Sears used to sell cocaine, codeine, and opium. They were profitable then.

But that doesn’t tell the entire story. Here is a great quote from today’s CNBC article on the matter:

A separate survey of U.S. consumers by Cowen & Co. found the average Sears shopper today is about 45 years old and makes a little more than $59,000 each year. The average Kmart shopper, meanwhile, is a little more than 43 years old and makes about $53,000 annually. That makes Walmart ($55,200), Burlington Coat Factory ($59,100), J.C. Penney ($61,000) and Ross Stores($61,400) the most comparable retailers for Sears and Kmart shoppers when looking at household income, the firm said.

J.C. Penney and Walmart set to benefit

Economics. In a recent study by the Pew Research Center, the middle class is defined as a household with two-thirds to double the national median income. This metric currently includes about half of American households. However, from 2000 to 2014, families that were considered “middle class” decreased in 203 of 229 studied metropolitan areas. This decrease has only accelerated in the past four years. Sears was built for middle-class mall goer. It’s been the thesis of 2PM, Inc. that retailers who’ve built their businesses for this American demo will continue to struggle until the American middle class rebounds.

JC Penney is another retailer that is facing these troubles. Whereas companies like Walmart, Target, Amazon, Dollar General, or Kohl’s have achieved growth by appealing to the upper middle class or economy shoppers. Straddled in debt, and with little to no visionary leadership, Sears failed to execute this pivot. The results have been tragic. Mall owners and commercial real estate developers will have to adopt new strategies to prevent the negative cycles that have occured in the past when anchor stores are abandoned.

But the real economic shift will be felt in exurban, lower-to-middle class areas. These areas are more dependent on shopping malls and the associated commercial real estate developments to fill their open swaths of land. This is where these communities go to shop, eat, and work. This is also where a sizable amount of tax revenue is generated. Without anchor stores or foot traffic for smaller businesses, exurban commercial real estate is nothing more than a house of cards. Next generation retail will not be there. And neither will appreciating homes.

2PM Data

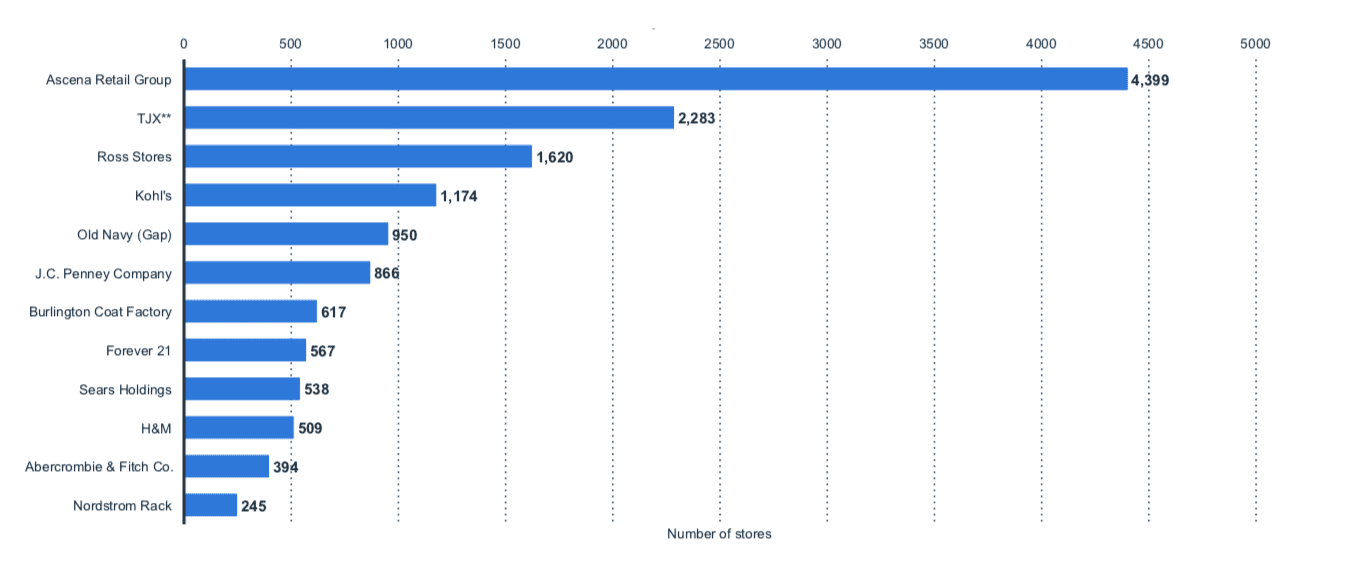

The top 100 retailers are listed below. A common misconception is that Sears was a forgotten retailer. In this recent dataset by Statista, Sears is currently in the top 40 stores in America.

[table id=29 /]

Here is a look several data points that will influence commercial real estate for years to come.

The Sears bankruptcy should be viewed as a warning shot for companies like: J.C. Penney, Burlington Coat Factory, and Ascena Retail Group – a conglomerate of middle class retail brands. Ascena is currently operating 4,400 stores in North America and trading at 25% of its historical highs. Retailers that have been dependent on debt and brick and mortar foot traffic are overdue for an evolution of their approach to reaching a) existing customers in a dwindling demo or b) finding innovative ways to reach new customers in growing demos: economy and up market.

The death of retail as we now know it is greatly exaggerated. Retail isn’t dying; it’s evolving. Just like it has done before. There has always been disruption in the retail sector. A major disruption occurred in the late 1800s when Sears introduced the catalog and brought the entire store into the homes of U.S. consumers. This gave Sears the same advantage over brick and mortar stores that eCommerce sites have today. Sears was simply responding to the needs of its customer since 60 percent of the U.S. population lived in rural areas at the time and didn’t have convenient access to stores. Sears would bring the store right to them.

Nearly 111 million square feet of retail space will be lost in this bankruptcy. For the Tier A malls that will be affected by Sears’ closings, consumers will see new consumer or events spaces in place of the historic retailer. But for Tier B/C malls, Sears’ closing will become another eyesore that will influence aspirational consumers to shop elsewhere. Sears once thrived on the principles meeting customers where they were. Evolving customer needs requires leadership that understands where consumer mindshare and dollars are going.

Read the curation here.

By Web Smith | About 2PM

Contributor: The 4C’s of Digital Branding

NEW YORK — For every GOOP, there are many failed online retail ventures in the celebrity brand space. Do you remember Blake Lively’s Preserve?

When it comes to online retail, success is more unpredictable than ever. This is because much of today’s commerce currency is derived from social influence: the undeniable effects that individuals have on strangers’ purchasing decisions. We almost never make decisions independently of one another. Faced with the abundance of choice, we rely on others to influence what to buy, read, wear or even how we are entertained. We also conform to the tastes of others, less out of actual merit. More so out of allegiance to that individual’s opinions.

Consumers adopt a business because other people are already there.

Glossier did not succeed because of product alone. It succeeded because women wanted to enjoy the benefits of sharing their choices, preferences, and looks with like-minded consumers. For digital retailers, more often than not – a product, brand, or technology is the substance but not the reason behind the success. Consumers adopt a business because other people are already there. Kylie Cosmetics does not win on the merits of eCommerce alone; there are better storefronts on the web. But technology hardly ever deters her fans.

More than ever, success is then a matter of cumulative advantage. Something becomes popular mostly because a lot of people like it, not just because it is superior. And because a lot of people like what they think others like, community doesn’t just reveal our preferences. They actively shape our preferences.

The quest for the next GOOP or Glossier will remain elusive as long we fail to look beyond technology and towards the social activity as the source of an online retailer’s value. This social activity is an amalgam of what I call the 4C’s: community, content, curation, and collaboration. They critically impact how a company launches and markets its products and creates, captures, and delivers value for its customers.

Community: A retailer needs to encourage social connections among its customers. These social connections will become its primary source of value and a key driver of competitive advantage. Social connections work best when created around an audience’s pre-existing passion, hobby, or interest. High-design ride wear brand Rapha positions itself as a “vibrant ecosystem for road riders around the world.” Its belief that cycling transforms lives translates into the series of local Rapha Cycling Clubs, where cycling enthusiasts can gather for events, rides, races and to bond with others. Rapha is at risk of losing its positional advantage by ending many of these programs.

Content: Content created by a retailer generates value even before a single product purchase or use of service. California-based fashion apparel brand Dôen creates social network around its proprietary content. The brand prides itself on selling “thoughtfully designed clothing by women, for women.” This community of women is Dôen’s value proposition, and it consistently delivers through its product design, events, and Journal. There, Dôen profiles the extraordinary stories of community members and becomes a source of continued conversation.

Curation: A retailer’s new customers can lower the value for its existing customers. To prevent reverse network effects and maintain a high signal-to-noise ratio, retailers need strong curation and personalization. In order to ensure that its products and services are relevant and valuable to its best customers. For example: Adidas introduced Creators Club, a membership program that gives customers access to exclusive events, products, and special offers.

Collaboration: Ask what else your customers are wearing, reading, listening, experiencing, and talking about. Relevance of a retailer for its target group is greater if it is culturally amplified. IKEA’s collaboration with a streetwear brand Off-White aims at designing the affordable furniture collection for millennials to help them create their first home. More importantly, it reflects a broader taste for the aesthetic of their joint audience.

No one knows who the new GOOP is going to be. Instead of projecting the next success story, we can create one by making our technology inherently social. To increase the odds of creating a cumulative advantage once the product or service is in the market, retailers must build 4Cs into their core. In the complex and unpredictable world of online retail, designing for social influence is a brand’s best bet.

Read the No. 291 curation here.

By Ana Andjelic| Edited by Web Smith. About Ana: most recently the Chief Brand Officer of Rebecca Minkoff, Ana has earned her doctorate degree in sociology and worked at the world’s top advertising agencies. She’s also a frequently published author, public speaker and writer. She lives in New York City.