The pandemic was supposed to change how we shopped forever and it did, for a moment. But then things began to resemble the pre-pandemic way of life. This reversion to the mean is not as simple as it seems. In March 2020, as Americans were shaken by a once-in-a-century disruption, lawmakers passed a $2.2 trillion stimulus package within days of the initial shock. Two more installments followed in late 2020 and then in 2021. The Washington Post noted in March 2021:

The United States appears to have spent more than anywhere else on coronavirus relief. The U.S. economy is the largest in the world, so the country has more to spend.

This was a justified economic calculation, even if it was driven by political convenience. It lessened the blow of a 100-year shock. Even so, unemployment rose to about 14.1% as Spring 2020 turned to summer and poverty rates in the United States fell from 11.8% to 9.1%. The negatives began to emerge as consumer prices rose, reflecting the unintended cost of market manipulation: inflation. And this is but one of the forces to include recessionary forces and supply chain inconsistencies. The American GDP has fallen for two consecutive quarters, by 1.6% and 0.9%. Supply chain backups dominated retail headlines last year. In October of last year, we broke down the cascading effects caused by supply chain disruptions. Recall where the international supply chain stood in October of 2021.

There are currently 90+ ships drifting off of the coast of Los Angeles and Long Beach, California. Nationally, truck drivers are employed at historic lows. Internationally, retailers are concerned by the news that China has begun limiting power at its many factories and shipping facilities, further hindering import timelines. And some of the most fortunate brands are buying the ships necessary to move products from A to B with some semblance of reliability.

Consider March 2020 through early 2022 and the three market forces (stimulus, supply chain shortfalls, COVID restrictions) interfering with one another. These simultaneous influences meant that the demand for consumer goods skyrocketed as availability was limited. The US economy was artificially influenced by the three largest stimulus packages on Earth and physical stores were closed as COVID restrictions hindered operations. That was then, this is now.

The most important industry trend influencing eCommerce may not be the two consecutive months of falling GDP. Rather, it lies at the intersection of our consumer price index (9.1+%) and the overstocked issue plaguing many of America’s largest retailers. A recent CBS report made the astute connection between October 2021 and today’s very different circumstances. Because of issues related to understocked shelves and warehouses, retailers overcompensated on product orders for Spring, Summer, and Fall 2022 without considering the effects of the economic stimuli and the reallocation of spend from events to products throughout the two-year period of COVID restrictions:

In a big surprise for shoppers who have been burdened by rising prices, there are deep discounts in stores across the U.S. The merchandise on cargo ships stuck at sea during the supply chain crisis is now crowding store shelves, prompting big sales. “It’s a retail armageddon,” Burt Flickinger, managing director for Strategic Resource Group, told CBS News.

Stores like Walmart overbought to account for previous supply shortfalls. Those retailers bet on persisting consumer demand and higher wages. Now, these same consumers are incentivized to shop at the large retailers with excess inventory. Thanks to the rising consumer price index and rising layoffs, sales at retailers like Walmart, Target, and others have driven the return of traditional consumer behaviors (in-store shopping, value-searching, convenience over luxury). This brings us to one of the biggest developments in retail. One of the most well-run companies in all of retail announced layoffs.

This week, Shopify announced a 10% reduction in a workforce. CEO Tobi Lutke took the blame for betting that eCommerce would leap 5-10 years forward.

Shopify has always been a company that makes the big strategic bets our merchants demand of us – this is how we succeed. Before the pandemic, ecommerce growth had been steady and predictable. Was this surge to be a temporary effect or a new normal? And so, given what we saw, we placed another bet: We bet that the channel mix – the share of dollars that travel through eCommerce rather than physical retail – would permanently leap ahead by 5 or even 10 years. We couldn’t know for sure at the time, but we knew that if there was a chance that this was true, we would have to expand the company to match.

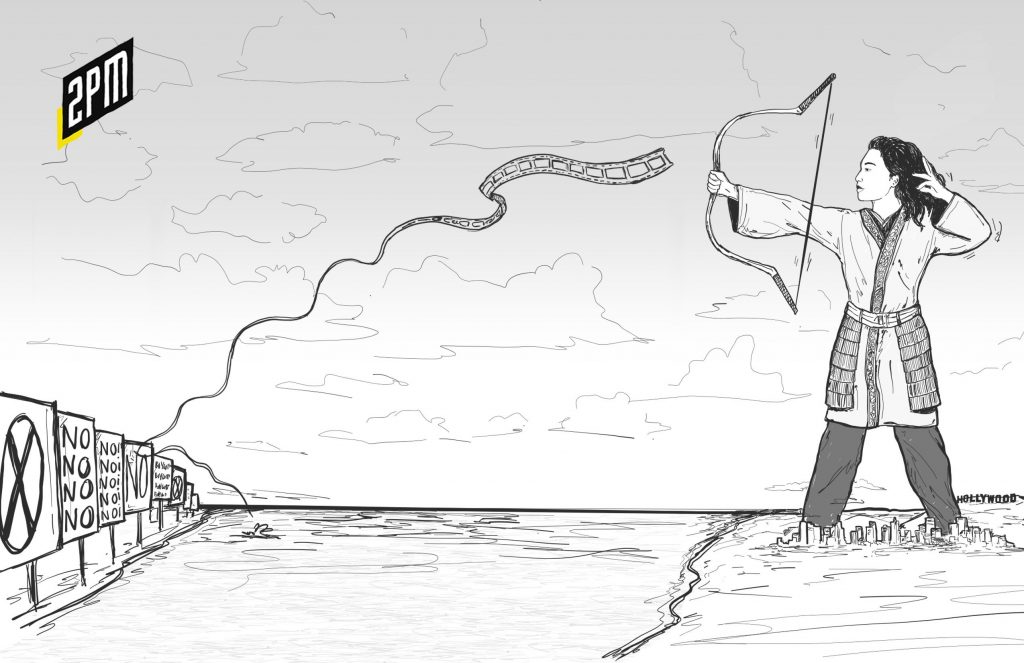

Lutke cited a figure that many analysts use to determine the influence of online retail on the American consumer market. But despite the well-written letter, I am not sure that his reliance on this figure is fair or accurate. While the image used in the open letter showed a sharp crash in eCommerce interest, the reality behind the trend line is not as dramatic. We have designed the one below based on the census data that he cited. We have also projected out where we feel eCommerce will land as a percentage of all retail when the new census data is reported on August 19, 2022.

In the May 2020 essay on J-Curves and Agglomeration, I explained that the online retail industry’s recent rise was a product of political and societal influences. And so would its temporary return to normalcy:

The recent shift to online retail has been reactionary. The next phase of eCommerce growth will be more intentional. But first, the bottom of the J-curve.

The market is nearing the bottom of that J-curve. But despite the shift in retail from digital back to physical, eCommerce is still “approaching a $1 trillion annual run rate” according to Marketplace Pulse, Insider, Forbes, and Retail Dive. This means that eCommerce is in a much better place than it was in 2019. Marketplace Pulse added:

Despite only a slight increase in market share, the e-commerce market has almost doubled in three years.

In that time, Shopify’s workforce doubled over the period represented by the last three bars from the right (2019-2021).

To Lutke’s credit, no one could have determined how the numerous forces would impact eCommerce growth. But there is an aspect of online retail’s next several years that analysts may be able to project and this could help Shopify maintain the rest of its workforce in the coming years.

The final market force weighing on eCommerce is the DTC industry’s battle for profitability. Performance marketing has become a less reliable tool and inventory costs continue to fluctuate. Fast Company published a recent report on Customer Lifetime Value (CLV) as a better measure for brands pursuing profitability:

Despite dramatic swings in e-commerce growth pre- and post-COVID, the fundamentals revealed in the IPOs of direct-to-consumer (DTC) darlings like Allbirds and Warby Parker present a serious wake-up call for the retail industry. As it turns out, customer growth does not generally equal profitable growth.

I believe that marketplace strategies for brands is the answer to customer lifetime value. Just this week, Glossier signed to sell within Sephora. Just a few years prior, Glossier was adamant that it would remain a direct brand. More DTC retailers will move to develop wholesale relationships with top marketplaces.

There are indicators that suggest that online marketplaces are more resilient during periods of economic distress. If you look at a cross-section of eCommerce retail stocks (Amazon, JD, Alibaba, Ebay, Etsy, etc) and compare them to software stocks (Shopify, BigCommerce, etc), marketplaces performed better than software companies. And this is where things can take a positive turn for Shopify.

Online retail remains important to the market, customers are reacting to a number of macroeconomic and acute economic pressures, and Shopify has access to countless desirable brands on the market. In China, where Shopify recently chose to partner with JD.com, marketplaces dominate online retail. There are lessons there. The majority of sales occur through online and physical retailers that aggregate brands. In fact, the top eCommerce presences in China (the most advanced eCommerce nation), are marketplace retailers. I believe that consumers want their eCommerce to resemble their real lives.

We visit Target, Walmart, Best Buy, or our favorite mall to discover new goods and easily access what we’re already aware we want to purchase. Amazon Prime Now’s key feature is that it already knows which items you’re most likely to purchase again – so it makes it easy to do so. Shopify’s super power is its access to its brand merchants and their data. And what the market is telling Shopify is that marketplaces are rewarded even during times of economic distress. Aggregating and organizing thousands of its top brands would change Shopify’s strategy but it may also save an ailing DTC industry as a result.

Consumer behaviors seem to suggest that they want simplicity in how they buy goods and services, whether offline or online. Marketplaces benefit consumers and brands alike. For consumers, it means more products in one place. For brands, it means more visibility and less reliance on performance marketing spend. Like China’s advanced market suggests, Shopify could add to its resilience by becoming the marketplace for its many brands. If not, Amazon may pursue that strategy on their own. I’d bet my hat on that.

By Web Smith | Edited by Hilary Milnes with art by Alex Remy and Christina Williams